Collectibles — often known as passion investments — are one of the most intriguing categories in the world of alternative investing. Whether an investor’s interests lie in fine wine or rare stamps, many choose to amass a collection as a hobby, while others are keen to diversify their portfolio, or are looking to protect their ventures with inflation hedging.

The Rise of Alternative Assets

26th October 2023

Today’s investors are turning to alternative assets that reflect their own interests — and are reaping the increasingly lucrative rewards.

The Rise of Alternative Assets

According to the Knight Frank Luxury Investment Index from its Wealth Report 2023, passion investments are flying high, despite current global economic concerns or the lingering impact of the pandemic. In fact, 2022 saw the collectibles market increase by a robust 16%, “comfortably beating inflation and outperforming the majority of mainstream investment classes, including equities”.

“Many of our clients are passionate collectors; their collections include antique clocks, musical instruments, rare manuscripts and vintage cars,” says Clare Anderson, UK Head of Schroders Family Office Service. “Many of these collections are now worth significant amounts — and, in some instances, a very meaningful proportion of overall wealth. Additionally, many collectibles have held their value during recent periods of market stress, and as a result have helped to diversify wealth.”

Traditionally, established luxury goods, such as art, classic cars, antique furniture, and watches and jewellery, have led the collectibles market. However, recent trends show canny HNWI and UHNWI investors shaking up their portfolios with promising new assets.

Prestige Spirits

Take prestige spirits. The latest Luxury Brand Index report by the Distilled Spirits Council shows that the luxury spirits sector experienced solid growth over 2022. While Scotch remains one of the best performing alternative asset classes — with bottles by names such as The Macallan and The Dalmore often breaking records at auction — rare, ultra-aged rum is tipped to be the next big thing.

“Big spirits companies, such as Edrington and Pernod Ricard, are finally investing in rum because they predict strong compound annual growth over the next 10 years, something they do not do lightly,” says a Cask Trade spirits specialist. “There is also an increase in consumer demand because brands such as Master of Malt are listing independently bottled cask-strength rums, while reputable independent bottlers like Berry Bros. & Rudd are showing confidence in the sector by releasing single cask expressions from Caribbean distilleries.”

Brands to watch include historic Colombian distiller Dictador, Nicaragua’s Flor de Caña and Barbados’s Foursquare, as well as Caroni of Trinidad. What’s more, top whisky purveyors are expanding their ranges with investment-grade rum. Cask Trade recently confirmed an exclusive three-year cask partnership with Renegade Rum, a Grenadian distiller producing terroir-driven, single cane spirit.

“With rum, it is important to look for provenance, just like when investing in whisky, watches or art,” adds the Cask Trade specialist. “Also, look for quality of produce, such as rum produced with natural sugar cane and not molasses, in addition to quality distilling equipment and casks.”

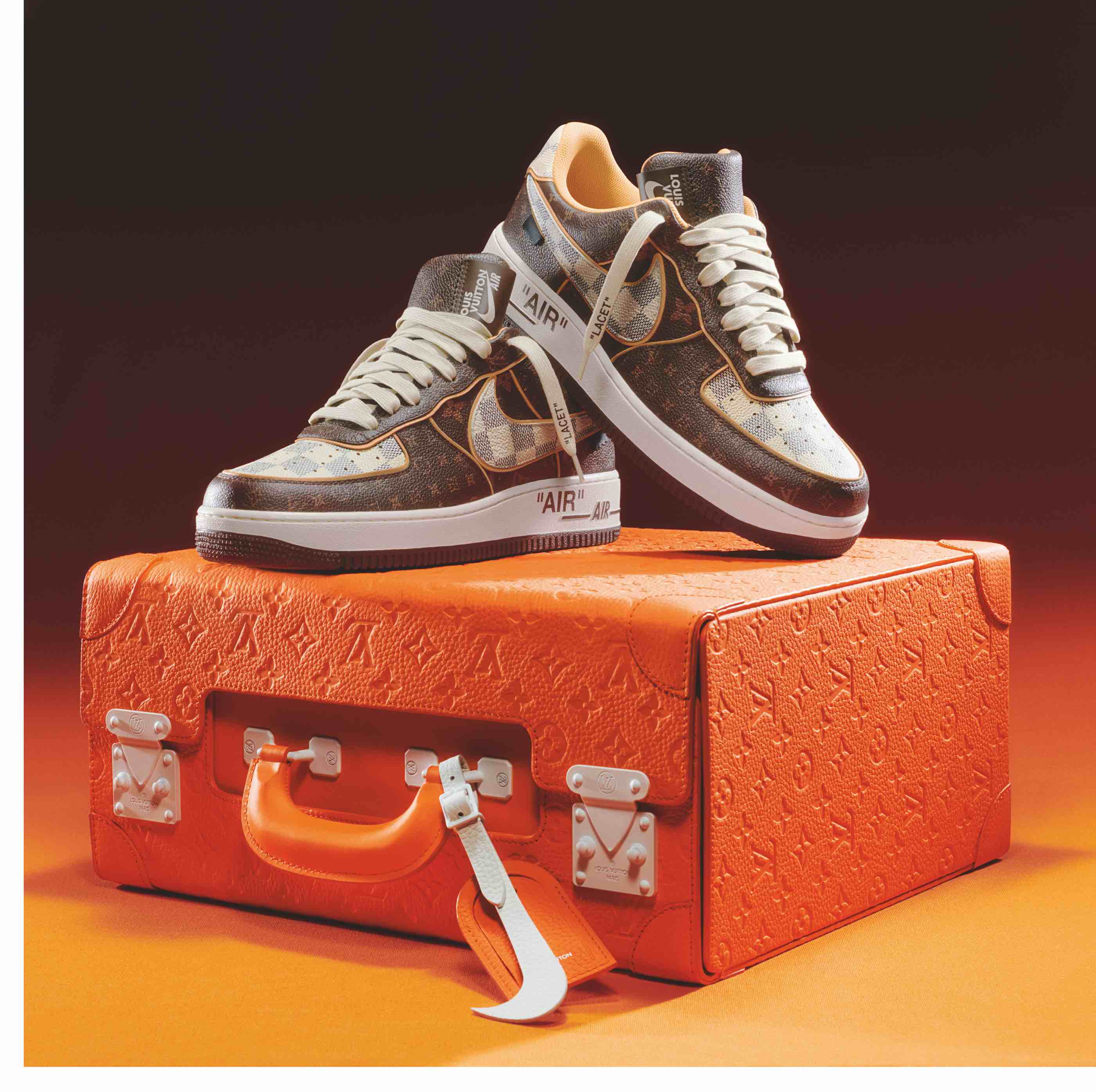

Zaki Vanderlip, Sotheby’s resident sneaker and streetwear specialist, explains that the market for rare or limited-edition sneakers is vast, attracting investors across an incredibly broad range of ages and demographics.

“Sneakers are very exciting and wide-ranging, and also very liquid — you can sell them across a variety of platforms and there are always buyers available,” he says. “Less than 5% of people buy these sneakers to wear them — a lot of these items are cultural artefacts. Because of the foresight their original owner had, to keep a pair of just-out-the-factory Nike sneakers totally pristine in 2001, their value is now derived from the fact that nobody has ever worn or touched them.”

Last year saw Sotheby’s record-breaking sale of the Louis Vuitton x Nike Air Force 1 by Virgil Abloh sneaker collection, which achieved $25.3 million in total. One pair went for an eye-watering $352,800 — 23 times its original estimate of $15,000.

Interestingly, it is not designer trainers by luxury labels that are most in demand among sneaker heads, but rather from brands of a much more accessible nature. “Nike dominates the market, along with its Jordan brand,” says Vanderlip. “We also have demand for unique releases, like one-of-a-kind Adidas pieces or Apple sneakers. From a collection standpoint, designs from the early 2000s are incredibly strong.”

Jewellery and Precious Gems

One forward-thinking business is now offering a more promising opportunity. Founded by investment management exec Dana Auslander, Luxus is a New York-based alternative investment platform specialising in fractional ownership of high jewellery and precious gems. Its luxury assets are securitised as publicly traded equities. For instance, investors can stake a partial claim of The Kwiat Luxus Round Brilliant diamond — worth $400,000 — at just $250 a share. They can then either wait until the stone is sold to a private buyer to reap the rewards, or sell their shares on the secondary market.

“We are still about five years from this model becoming mainstream,” says Auslander. “But we are setting down the rules and creating a template for how to invest in esoteric assets. I started Luxus because there was a glaring omission in the marketplace for precious gems. Traditional investment firms have tried to ‘financialise’ diamonds but haven’t gotten anywhere. Nobody was offering products around precious gems and jewellery, despite it being the dominant category in luxury.”

Elsewhere in alternative assets, gold has long been prized as both a long-term store of value and a reliable investment hedge against other asset classes, not to mention for its liquid asset appeal. Specialist bullion brokers, such as Sharps Pixley in St James’s, trade in high-quality gold bars and coins, and also offer secure vaulting services.

While gold and other precious metals remain a relatively safe bet for long-term appreciation, they are not the only elements in play. Still in their relative infancy as a mainstream investment option, battery metals — which, alongside ‘white oil’ lithium, include cobalt, nickel, manganese and graphite — are experiencing a boom. This is in line with the increasing shift away from carbon-based energy towards greener, more renewable options, as battery technology also becomes increasingly sophisticated for use in everyday electronic devices, such as laptops and smartphones. The growing sector of electric vehicles is also advancing the trend.

As demand for battery metals is, in many cases, fast outstripping supply, interested investors would do well to make their move sooner rather than later. And while mining companies are not historically known for their eco-credentials, more sustainable investment alternatives are out there, such as clean energy fund Vision Blue Resources.

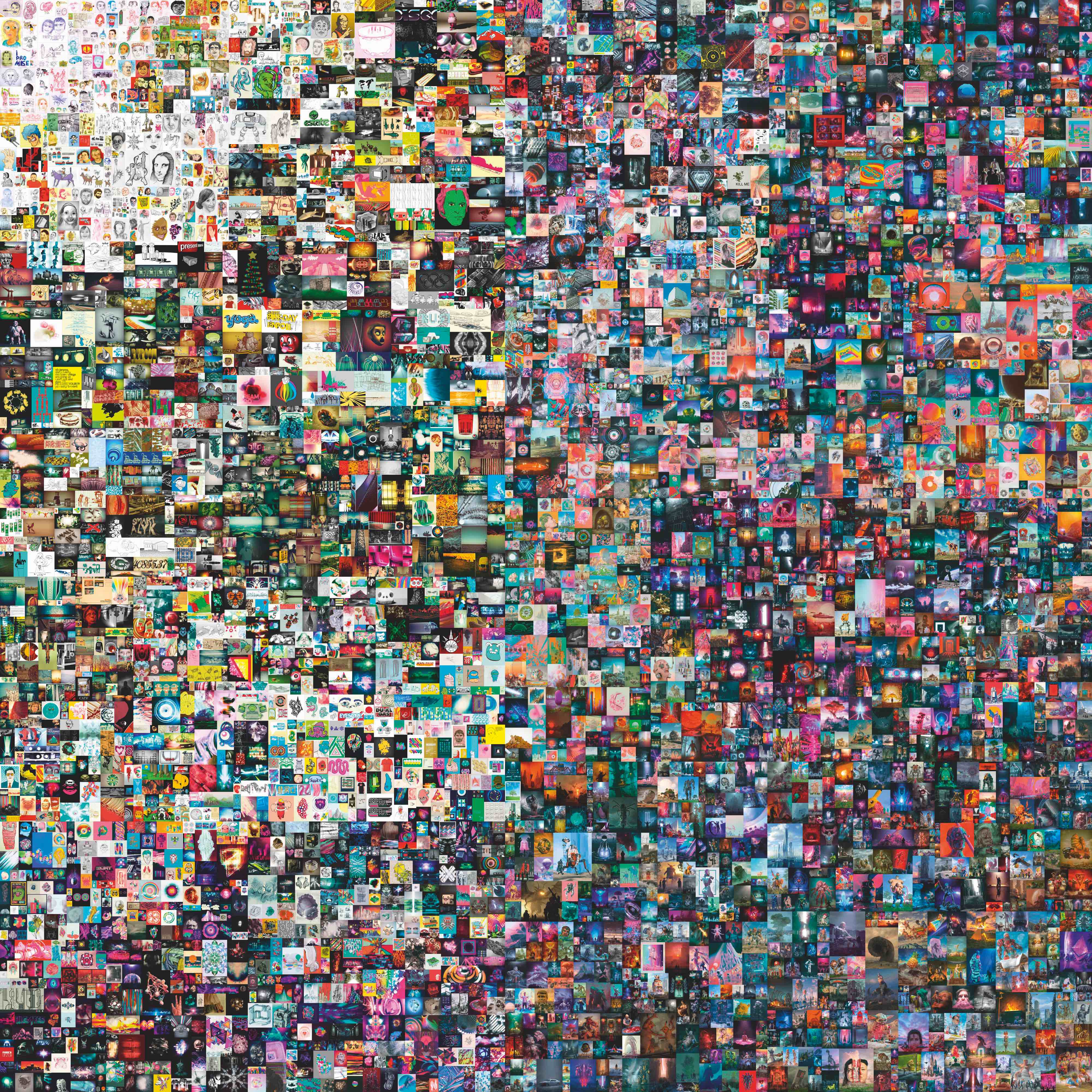

Non-fungible Token (NFT) Artwork

Lastly, in the art world, it is impossible to discuss new collectibles without mentioning NFTs (non-fungible tokens), the unique digital assets that can be bought and sold via blockchain technology in the metaverse economy. The old guard may sniff at NFT art as a flash in the pan, but recent numbers speak for themselves: last year, some 87 NFT artworks went under the hammer at Christie’s for $5.9 million. The NFT that has achieved the highest price to date at the auction house is digital collage Everydays: The First 5000 Days by Beeple (aka Mike Winkelmann), which sold for a staggering $69,346,250 as a single lot sale in March 2021.

“We are still in the infancy of digital art’s path to the mainstream and implementation of NFT use-cases in the arts,” comments a Christie’s spokesperson. “However, Christie’s remains committed to advancing digital art and NFTs as a serious collecting category within contemporary art. Incredibly talented artists are using technology in remarkable ways.”

In fact, such is the demand for NFTs that Christie’s — as the first major name to bring NFTs to the international auction stage — has launched Christie’s 3.0, a dedicated NFT marketplace platform. Its representative asserts that digital art is here to stay: “Though the market continued to be tested amid the volatility of the broader crypto market landscape, demand for digital art still proved strong in 2022, so we are confident that there will always be an appetite for both digital and physical art."

While any investment comes with its own inherent risks, especially so with non-traditional models, for those with a penchant for passion collecting, these new alternative assets offer a fresh, diverting — and hopefully lucrative — way to broaden one’s portfolio.