JOHN HUMPHRYS: Alastair, there is a big contrast here. You believe in risk and now you are to become the Lord Mayor of the City of London, which is about as traditional as it gets. So could you explain this?

In Conversation with Alastair King, the Lord Mayor of the City of London

9th November 2024

Alastair King, the new Lord Mayor of the City of London, is quizzed by the broadcaster and journalist John Humphrys for The Lord Mayor's Show Programme about his appetite for risk and his vision for ‘Growth Unleashed’ in the City.

ALASTAIR KING: Tradition doesn’t mean that you don’t have risk. The insurance market has been part of London for centuries. So many of its foundational businesses have been managing risk over many centuries. I see an enormous opportunity in my Mayoralty in recalibrating us as risk-takers in the City. I’m fortunate to come from an entrepreneurial background and I built a series of businesses in financial services. But over the last 15 years or so, the City has forgotten how to take risk. In footballing terms ‘we’ve lost a yard of pace’. My role as Lord Mayor is to try and claw as much of that ‘yard of pace’ back.

What does that mean to someone who doesn’t ‘speak football’?

I’ll give an example – in the early 2000s, a good part of the Swedish banking system moved en masse from Sweden to London, because they felt that this was the bestregulated market with the most impressive employees. Since 2008 there was a series of regulatory changes and mindset changes, and we’ve gone down a ‘safetyism’ route. “It’s all a bit hairy out there, let’s not go to the far pavilions, let’s concentrate on what we’ve got.” That goes against what the City has done for centuries. Look at Indonesia growing at 5-6%. Indonesia wants so many of the things that we can offer – advice in project finance to build irrigation programmes and build their new capital. Yet if you present to the Chief Risk Officer at the banks here in the City with a project in Indonesia, sadly it would probably be rejected.

Yet if you are talking to somebody who is an investor, such as myself, the first thing I want to know when I go to a bank who is looking after my money, is it going to be safe?

I accept this. But you are not necessarily financing projects in Indonesia. There are plenty of institutions that want to take risk and see the opportunities for growth.

But are they gambling with your money?

One of the great skills within the City is to match an individual’s desire for risk with projected returns. Where we’ve got a problem is that we’ve put too many things in ‘the too difficult’ pile. It’s within our muscle memory and we know how to do it.

Are you talking now as the new Lord Mayor or as your own man running your own business?

As the new Lord Mayor. One of my roles is to push the Government and the regulators to have a better regulatory framework. That may take up to a decade, but there are some ways in which we can seek to influence the new Government now.

If you had asked me before this conversation what the Lord Mayor of the City of London does, I would say, “Well, he’s sort of a ceremonial figure. He gets dressed up and he makes a lot of speeches”. So this is an eyeopener for me.

There are two elements to the role of Lord Mayor. One is the overseas programme. I will go around the world representing the City of London and telling people: “If you want to raise debt, do it in London. If you want to raise equity, do it in London. If you want to insure yourself against catastrophe, do it in London. If you fall out with your partners, then sue them in London.” That’s looking for inward investment coming into London. The other element is outward-facing. Jardine is a good example of a company that’s been doing business in Indonesia for 200 years and they are subject to the same regulatory framework as every other business. So I can show the City: “Here are the ways in which you can, even subject to the existing regulation, get out there and start trading in some of these extraordinary dynamic markets around the world.” And it’s not just Indonesia, it’s the Philippines, Thailand, Vietnam, Malaysia, other parts of the world.

What about China?

China is certainly going to be part of it. We have three perennial Mayoral visits each year - those to India, the United States and China. If London wishes to retain its position as the number one global financial centre, then we have to trade with the second-largest economy in the world. We have 40 Chinese-based financial institutions present here in London and they want to do business with us.

Do you have any reservations about the influence of China?

We are not policy-setters, but I will be following the FCDO guidelines (The Foreign Commonwealth and Development Office). We will work within their constraints and follow their briefings. One of my roles as Lord Mayor will be to make sure that London has integrity around the world. So we have to keep a watching brief on it and take a lead from the Foreign Office in relation to the line to take.

You said earlier that London is the greatest financial centre on the globe. Surely that’s New York?

New York is obviously extremely good and impressive. But much of the capital flows are national capital flows. London is a much more of an international financial centre. The City of London does an annual quantification of the 10 major financial centres in the world and comes up with a ranking. London still ranks number one.

Who is our greatest competitor?

New York, then Singapore, Hong Kong, and Paris as well. Where London scores is that we have several markets where we’re either first in the world or a good second. We are first for insurance, for legal services and foreign exchange. We are a good second for asset management and banking. So if you look at all those sectors together, then we still come out number one. But your point is a good one, and five years ago we were head and shoulders above everyone. We have declined, others have gained on us, and now we are only just number one.

What might push us off that throne?

If we forget our international bias: there are 300 languages spoken in London, we have this extraordinary network of networks and deep expertise in the talent pools within all the communities that make up the City. But if we were to turn our backs on these networks and become insular, then we will have problems.

Are we over-regulated?

Yes. One example is pensions – we have the second-largest pension system in the world. The pension pot for the United Kingdom is roughly £4 trillion. We also have some remarkable capital-hungry businesses, often coming out of universities in technology and chip design. A great example is the Crick Institute, the largest biomedical laboratory in Europe, with 1,250 scientists coming up with extraordinary genome research. There are people banging on our door wanting to finance that genome research. Virtually none of them are British – they are American or Chinese. We have this extraordinary innovation here, we have this big pot of money, yet we have built a wall from the floor to the ceiling that effectively stops the great chunks of money coming through.

The regulatory wall?

Indeed. There was legislative and regulatory overshoot following the Maxwell pension scandal. The thing you always hear is, “It must never happen again.” Therefore there has been copper bottoming to make sure that it didn’t happen again, which has meant that pension funds have become rather risk-averse. If you look at four comparable economies in the world, South Korea, Japan, Italy and Australia, their home institutions own between 37% and 49% of their local stock markets. The equivalent figure in the UK is just 2.7%. That’s partly because of this regulatory wall. My colleague, Sir Nicholas Lyons, who was Lord Mayor until November 2023, started the process of trying to punch a few holes in this wall to get some of this sort of money through.

Sounds very much to me as if you need some dynamite!

Exactly! Nicholas did something called the Mansion House Compact, which was adopted by Jeremy Hunt and the Treasury and is an agreement among the top 11 pension funds to commit 5% of their assets into risk assets by the year 2030. It’s an entirely voluntary scheme, but it’s a public declaration to the world that the British pension funds are going to start to fund some of these growth opportunities again.

So that was his legacy. What is yours going to be?

The tagline for my Mayoral year is ‘Growth Unleashed’.

Don’t politicians say that and then fail?

There are two elements: What can I do to push regulatory reform? There are many reforms on which we can work with Government and we’ll be pushing for these changes. That might take some time. The second element therefore is to say to business: - don’t wait for this regulatory reform, go off and seek new markets now!

But then you go to jail!

No, there are ways to do it. It involves taking some risk and looking for clearer guidance from the regulators. We need to change the narrative. Where else in the world can you get high single-figure returns or low double-figure returns on a sustained basis with good rule of law in a safe political environment? So with my ‘Growth Unleashed’ idea, I think the City should be firing on more cylinders than it is firing on now. With a couple more cylinders, that can be a remarkable engine for the UK economy. So if we can reboot our London Stock Exchange, which has had some trouble, and we’ve got a confident risk-thinking financial sector, they are both really good things for the economy.

On one level I love the way you have used the word risk so many times in this conversation. But on another, I say to you as an individual investor, with a few quid in the bank: I don’t want to risk any of my money.

The great thing about the City is the plant is already here, the offices are built, the people exist, they’re properly trained, they’ve got their regulatory approvals. They just need the green flag to go off and do things. So the City needs a cheerleader, like a subaltern in wartime, someone who’s going to grab a rifle in one hand and a shovel in the other and say, “Right everyone, follow me.” That’s how I see my role.

The bedfellow of the word risk is growth. Growth doesn’t come out of a box. The only way you get growth is via risk. Where else does the growth come from in the next five years? We have a planning system which is antediluvian. If you read the stats for example on grid connectivity for new projects, you can be waiting years.

What is also required of the Lord Mayor of the City of London is a tolerance for the ceremonial bit.

The ceremonial bit is extremely popular abroad. It is a calling card. The subtitle for the role of Lord Mayor is ‘Global Ambassador for the United Kingdom’s Financial and Professional Services’. So to wear something that is recognised in key markets we’re trying to influence is not a bad thing.

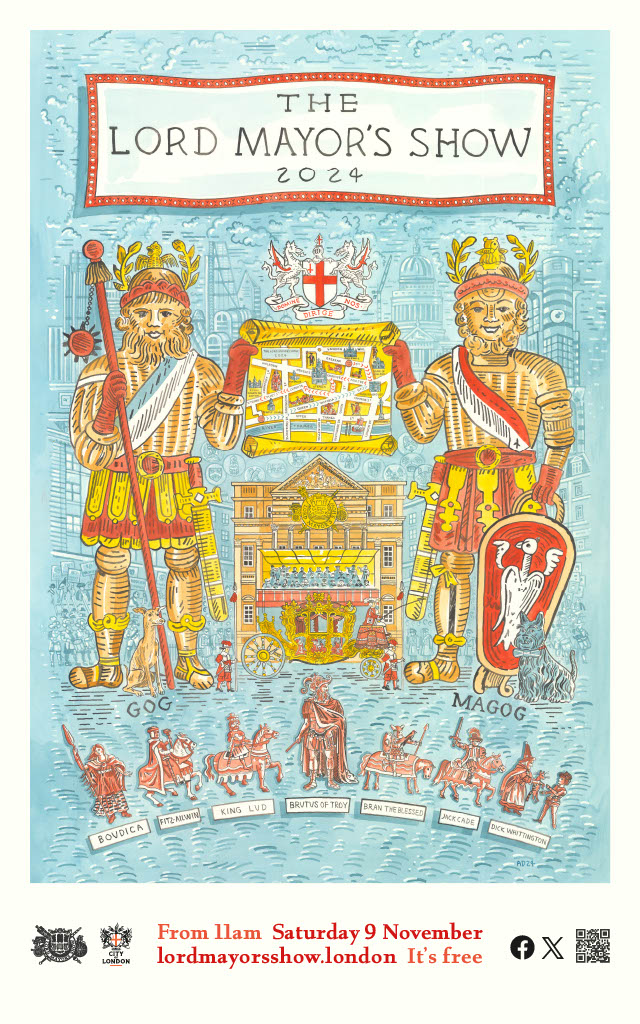

Why has the Lord Mayor’s Show lasted for centuries and why does it matter?

It’s an extraordinary showcase. You are able to bring into the Lord Mayor’s Show a number of the organisations that are close to you. I’m Chair, for instance, of the British Liver Trust, so there’s going to be a big float in relation to fighting liver disease, and some of the key markets that I will be approaching as Lord Mayor will be represented in the show. Also I’m a very proud Scot from Aberdeenshire, so my Lord Mayor’s Show is led by the Royal Regiment of Scotland, with their Band, Pipes & Drums and the regimental mascot is a Shetland pony, called Corporal Cruachan IV.

On a personal level you have a new wife to help you with all this. Because this is a job for two people?

I’m very lucky in that respect. Although up until 10 years ago or so, The Lord Mayor was generally accompanied by their partner everywhere. Now it’s only one or two overseas visits because of the logistics. My wife Florence has her own area of expertise. She’s a serving reservist in the Army.

Is it true you aim to encourage the City to offer more reserves? They wouldn’t need to dig trenches?

Absolutely right. Florence is going to spearhead the recruitment and retention of reserves during our year in office. The skills that the people within the City have are needed by the modern reserve forces, such as data scientists. My wife has an MSc in Epidemiology, she’s a data analyst. Modern warfare requires data analytics, the sort of thing that the people in the City are doing every day.

So you will be The Lord Mayor who not only helped us to get richer, but kept us safer?

Goodness me, that would not be a bad thing.

How do you address the Lord Mayor, if you’re being formal?

My Lord Mayor.

My Lord Mayor, may I thank you very much indeed.

John, it’s been a great pleasure to talk with you. Thank you very much indeed.